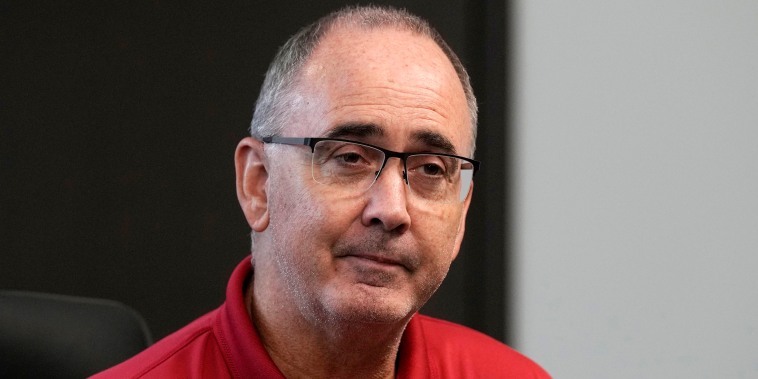

A strike by the United Auto Workers union against the Detroit automakers would help President Joe Biden and other politicians pick a side when it comes to organized labor, UAW President Shawn Fain said Wednesday night.

“I think our strike can reaffirm to [Biden] of where the working-class people in this country stand and, you know, it’s time for politicians in this country to pick a side,” he said during CNBC’s “Last Call” with Brian Sullivan. “Either you stand for a billionaire class where everybody else gets left behind, or you stand for the working class, the working-class people vote.”

The outspoken union leader reiterated that striking against General Motors, Ford Motor and/or Stellantis when contracts for roughly 150,000 auto workers expire after 11:59 p.m. Sept. 14 is not the goal, but the sides remain far apart when it comes to key demands.

“We’re down to the wire. We have eight days to go,” Fain said. “We’re pushing. We’re available 24/7 as we have been for the last seven weeks, so it’s up to the companies on where we end up and whether we end up having to take action or not on the 14th.”

Fain said the union is set to meet Thursday morning with GM, following a Wednesday afternoon meeting with Ford. Stellantis said Wednesday that it “intends to pass the UAW a counter offer to the members’ economic demands by the end of the week.”

Fain’s comments regarding Biden add to an unusual tension between the leader of the historically Democratic union and the commander in chief, who has called himself “the most pro-union president you’ve ever seen.”

Earlier this week, Fain said he was “shocked” to hear Biden say he was “not worried about a strike until it happens” and that he didn’t “think it’s going to happen.”

“He must know something we don’t know. Maybe the companies plan on walking in and giving us our demands on the night before. I don’t know but he’s on the inside on something I don’t know about,” Fain told reporters during a Labor Day event in Detroit.

The UAW has historically supported Democrats. However, former President Donald Trump was able to gain notable support from blue-collar autoworkers during his presidential campaigns. Fain has said he believes another Trump presidency “would be a disaster,” citing the need for the union to “get our members organized behind a pro-worker, pro-climate, and pro-democracy political program that can deliver for the working class.”

The UAW is withholding a reelection endorsement for Biden until concerns about the auto industry’s transition to all-electric vehicles such as job security, pay and organizing are addressed, Fain has said previously.

“Our endorsements are going to be earned not freely given and the actions are going to dictate who we endorse,” Fain reiterated Wednesday.

Simultaneous strikes against GM, Ford and Stellantis would be unprecedented. It also would mark one of the UAW’s largest strikes in recent history and could quickly have a ripple effect on the automotive supply chain, the U.S. economy and domestic manufacturing.

A strike against GM in 2019 during the last round of contract negotiations lasted 40 days and cost the automaker $3.6 billion in earnings that year, GM reported at the time.

The union’s current demands also could be costly if tentative deals are reached. Key demands include a 40% hourly pay increase, a reduced 32-hour workweek, a shift back to traditional pensions, elimination of compensation tiers, and restoration of cost-of-living adjustments, among other items on the table.